How Can I Maximize the Effectiveness of My Charitable Giving?

The Lord richly blesses all people, but in many different ways. While our assets may differ, many of them can be used to bless others. However, simply cutting a check isn’t always the most beneficial approach to charitable giving.

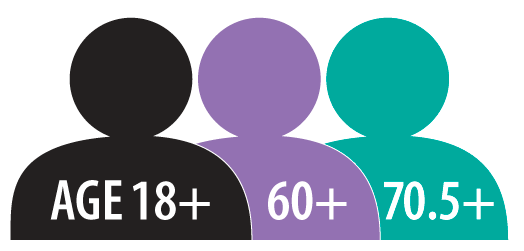

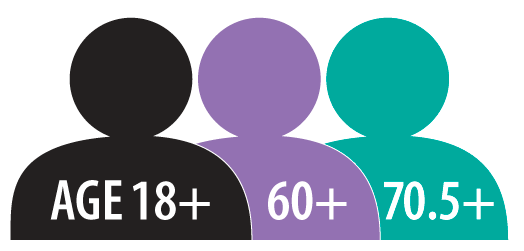

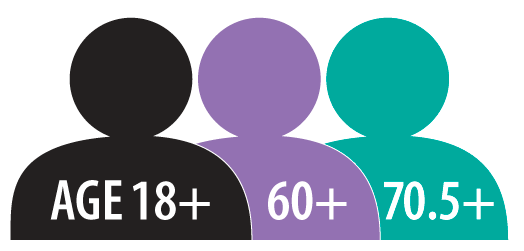

When managed strategically, not only may one’s contributions provide positive impacts, but donors could see a benefit to their tax situations as well. FVL’s Mission Advancement Team has developed a chart that can help anyone—regarding age, income level, and property—consider how their assets can be used for charitable purposes to maximum benefit, including support of Fox Valley Lutheran High School.

This chart may spur some thoughts for you to consider as you reflect on the Lord’s blessings in your life. How might you be able to use what you have to support and encourage others in their Christian lives and to spread the gospel of Jesus to others?

Use the chart below to discover ways that you might be able to maximize your support of ministries that are important to you, whether that is FVL or other ministries that are close to your heart.

If you have any questions, please feel free to contact our Mission Advancement Office for more information and assistance. We are always happy to talk with you.

Be sure to consult with your financial planner or tax advisor prior to making a decision. Charitable donations and their tax or estate impacts can vary widely according to personal circumstances.

Current Donation Options

Deferred Donation Options

CURRENT Donation Options

Employee Matching Gifts

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$ Minimum

Many employers match donations their employees give to non-profits. Usually, the company match is 1:1, but sometimes it is more. Check with your employer to find out if they offer this program.

Cash

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$ Minimum

One-time as well as recurring cash donations can usually be designated as charitable contributions on your taxes.

Appreciated Assets

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$ Minimum

Appreciated assets include stocks, bonds, mutual funds, and real estate. Donating the asset itself rather than the proceeds from the sale can provide you with tax relief.

Donor Advised Funds

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$10K Minimum

Donor Advised Funds (DAFs) enable "bunching" deductions in one year. This means you can consolidate multiple years of contributions in one year, maximizing tax benefits for you.

Qualified Charitable Distribution

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$ Minimum

Retirees can donate their IRA's Required Minimum Distribution (RMD) as a Qualified Charitable Distribution (QCD). QCDs are excluded from income for Fed. tax purposes.

DEFERRED Donation Options

Endowments

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$ Minimum

The principal in the endowment fund is invested, and the income from this investment is used by the non-profit. The principal fund remains intact and provides long-term benefits to the non-profit.

Beneficiary Designations

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$ Minimum

Beneficiary designations are deferred gifts from bank or retirement accounts. Life insurance also provides this opportunity. Beneficiaries receive funds at a later time.

Wills & Trusts

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$ Minimum

Wills and trusts provide support to beneficiaries at a later time.

Charitable Remainder Trust

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$200K Minimum

With Charitable Remainder Trusts, you make a gift of cash, securities, or real estate in exchange for receiving a regular, specified amount. Surviving children can benefit at a later time, along with your chosen charity.

Charitable Gift Annuity

Tax Savings

Capital Gains Relief

Survivors Benefit

Retirement $

$10K Minimum

With a Charitable Gift Annuity (CGA), you make a gift of cash or securities in exchange for receiving quarterly payments. Your chosen charity will benefit at a later time.

Use the chart above to discover ways that you might be able to maximize your support of ministries that are important to you, whether that is FVL or other ministries that are close to your heart.

If you have any questions, please feel free to contact our Mission Advancement Office for more information and assistance. We are always happy to talk with you.

Be sure to consult with your financial planner or tax advisor prior to making a decision. Charitable donations and their tax or estate impacts can vary widely according to personal circumstances.